Demystifying VC Diligence

Fundraising is hard. The monotony of cold outreach, the sudden rush when an investor responds, and the adrenaline of pitching your life’s passion on a 13 inch monitor, or if you are lucky, a coffee shop. Constantly pitching your idea, your baby, that you are spending every waking moment obsessing over, only to get email after email with a “no”. And even when the investors respond with a “hell yeah we are super interested…”, its usually followed by “…would love to dig in more…”. It’s only the beginning.

Seasoned and new alike, early stage founders I talk to are most anxious about due diligence. What are they looking for, how do I position myself for success, how do I make it quick? It’s a black box. Every firm has (or claims to have) a different approach to due diligence. In this post, I will pull back the curtain on everything you need to know about early stage venture due diligence — what it is, how to position yourself for success, and what are investors looking for.

PROCESS

Due Diligence is the process through which early stage investors - angels and VCs - evaluate investment opportunities to make an investment decision.

The exact process - items, requests, and length - of diligence depends on a few key things:

a) Stage of the company (pre-seed, seed, Series A, etc) -

Diligence for early stage companies is faster and focused on team strength and size of the market opportunity. At the earliest stages, there is not enough data on company performance for it to take any meaningful diligence time. As companies approach a Series A, a bigger part of diligence is “inward-looking” on company business metrics. As the company matures, diligence is longer and more detailed.

b) Investor Check Size (relative to size of the fund) & Lead / Follow-On Status -

Typically, lead investors “lead” the diligence process. Smaller, follow-on investors usually get access to the data room, but only get a very limited number of additional requests and access, and have little to no direct control over diligence timing.

The investor’s check size relative to their fund size is another key driver of their diligence expectations. A $30M fund looking to invest $2M in your company is investing ~6.67% of their fund in your company. You will be one of only 15 max portfolio companies in their portfolio. As a result, their diligence expectations will typically be higher than those of a $1B check writing a $2M check (investing 0.2% of fund).

There are six key elements of good early stage diligence: Team, Product, Market, Financials, Legal & Governance, and Customers. Diligence is usually conducted through three, usually concurrent, paths - through data provided by the company in the data room, direct meetings / calls with customers and industry experts, and investors’ own market research using first and third party data.

Let’s dig into each individual element, identify key data that should be included in the data room, and understand investor goals for diligence and likely additional requests.

TEAM

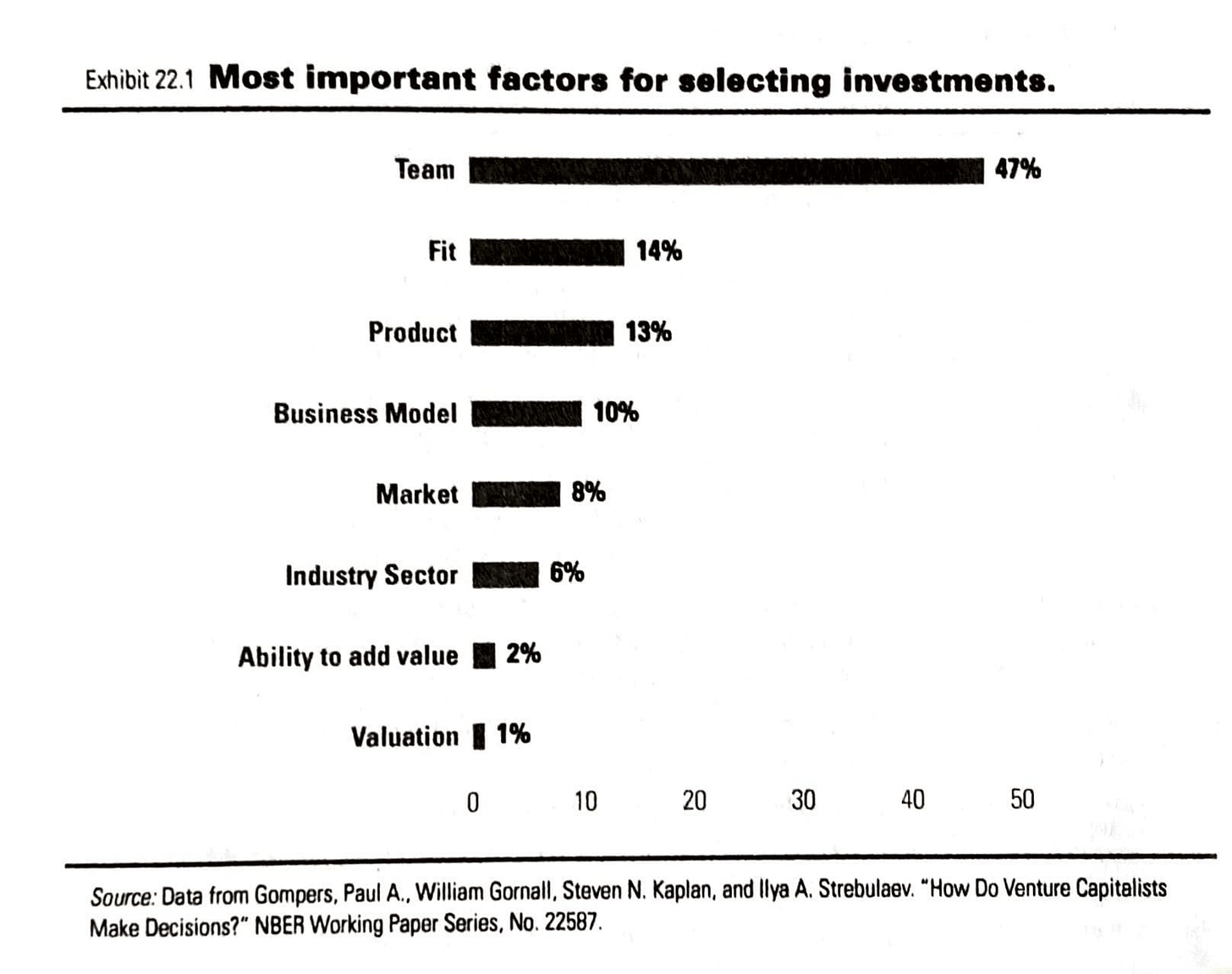

Startups are hard. Grueling. That’s why the team is one of the first key areas of diligence. Most early stage investors consider it to be the most important criteria (See exhibit A).

Team diligence begins as soon as you hit "join meeting" on your first zoom pitch call. Investors are looking for founding teams with a strong vision for the market opportunity and product, and the capability to build a team to execute against that vision despite all hurdles and setbacks. Plus, we are looking for signs that the team is coachable and willing to accept help – and is a team that we would enjoy being in the trenches with on a weekly basis.

Here is what successful founders do well:

- Add a detailed team slide in the data room to show the composition of the team and what they have done in the past. This helps demonstrate company pedigree and management’s ability to hire high quality employees.

- They are transparent and honest about their thinking around the market, competition, and business model. This helps us get comfortable with founder thought process and starts to give us insight into their decision making process

- They are remarkable story tellers. The importance of story telling deserves its own blog post, but the best founders craft the narrative with such passion, that they compel you to become believers, quickly. I have even met founders, where at the end of the intro call, I wanted to quit my job and join them in their mission.

They are transparent about their shortcomings and challenges. They don’t try to hide them.

- Side note here - sharing your biggest hurdles is a great way to do some reverse diligence. The best investors would love to jump in and immediately start helping you overcome these hurdles – independent of their decision to invest. Plus, it gives you a tiny taste of what it would be like to work with this VC for the next 7-10 years. If vibes are off, you can pass on the investor too!

Other Notes:

Don’t lie or exaggerate about your background, accomplishments, or company progress.

- Sadly, this happens

- We are looking for smart, honest, transparent founders. This usually does not mean be “rehearsed” or overly “polished”. Despite what a “pitch meeting” insinuates – you don’t have to “Sell” us on the investment.

- It’s a first date – keep it high level in the first meeting, and only dive in as necessary.

PRODUCT

This next one is obvious. Your product. The thing you are selling. Is it good? Does it work? How well does it work?

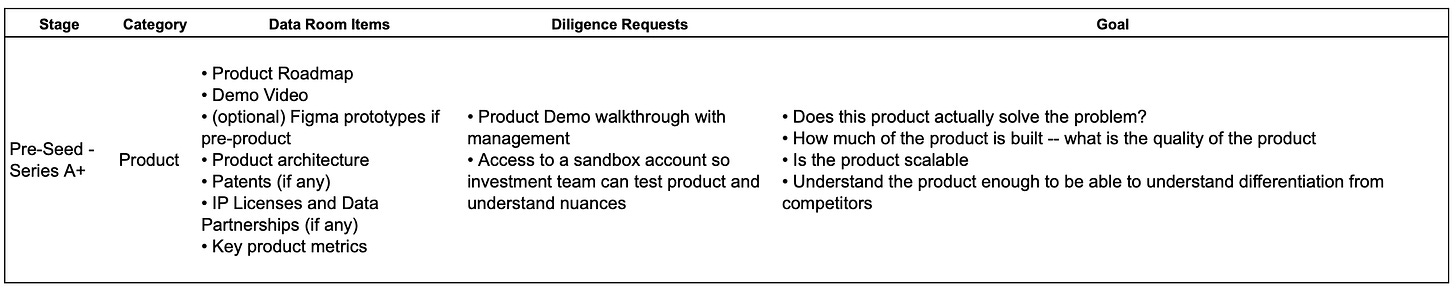

The goal of product diligence is to evaluate three key things. First, how does the product solve the problem? Second, how much of it is built? Third, how is it different and 10x better than the existing / old way?

There are three interdependent aspects of complete product diligence. Think of them as expanding concentric circles. The smallest concentric circle is the product itself. Usually this means going through a product demo and getting a test account to play around in the product. This is super useful because we can quickly get smart on how the product works, and on the quality of the engineering team based on our experience with the product. But this alone isn't enough.

Unless your target users are VCs, even if the product works aka all the buttons work, how do we know the product *WORKS* aka actually solves the problem it set out to solve. For this, we usually rely on customer calls.

The third aspect, the largest concentric circle – is the universe of all other products trying to solve the same problem. Good VCs will test all the other products in the market and compare your product to others to understand points of parity and points of differentiation.

Successful founders:

Add a detailed product demo in the data room and give investors a test account to play around in the product

- This is another opportunity for reverse diligence – the best VCs are going deep in your product so you will see usage data

- Share a thoughtful product roadmap built around business goals, and not just features.

Other notes:

- Be clear about what is built and live and what is currently “Figma-only”

- It’s okay if your product isn't perfect - don’t try to hide shortcomings. It’s easier to trust a B+ product we can use, touch, feel, and identify shortcomings (because we can fix them), than a product that looks A+ but is vaporware. Basically don’t pull a Theranos. Or Fyre Festival.

FINANCIALS

Financial due diligence can often feel like the most daunting aspect of the diligence process. Fret not, let’s break it into chunks.

Think of financial due diligence as having two discrete phases - backward looking (historical) diligence to evaluate performance and traction, and forward looking (projections) to evaluate growth potential.

Let’s start with historical diligence. The goal here is for us to evaluate your traction so far on your key business metrics. Usually one main metric is revenue, but depending on your business model could include other metrics as well (ex - for marketplaces, Gross Merchandise Value is another key metric). VCs are looking for consistently high month over month growth.

The second key aspect is unit economics and sustainability of customer acquisition. Customer Acquisition Cost (CAC), Lifetime Value (LTV), Annual Contract Value (ACV), Cost of Goods Sold (COGS), and Gross Margin (GM) are the usual targets. Understanding these business levers and their historical trajectory is important to creating the critical foundation to build future projections on top.

The third aspect of historical diligence is capital efficiency. Once we understand growth, and business levers, we need to understand how much cash did the business have to burn to achieve that growth. This helps us get an understanding going into the projections, of exactly how much cash the business might need to achieve their projected growth.

Once we understand the historical trajectory, we shift our attention to future projections. Looking through management projections is like peeking into the founder’s brain and how they see their business growing. Usually we like to see 2-3 years of projections through a monthly financial model. One key thing to understand – it's really the numbers for the next 12 months that need to have the highest fidelity. A lot can change to affect revenue 12+ months from now and nobody is expecting 2-3 year projections to be gospel truth.

In this aspect of diligence, successful founders:

- Highlight key assumptions and drivers in future projections

- Differentiate truly recurring revenue (annual contracts), re-occurring revenue (not contracted, but happens regularly predictably), and one-time revenue

- Are transparent about metrics that have underperformed, have a hypothesis for why, and an initial plan to fix

- Share excel versions of these files so we can play around this them (sorry, I had to put this in here - PDFs are a pain to work with)

Other notes:

- Use standard metrics wherever possible. No “community-adjusted EBITDA” please. If there is a key reason for your business to look at a unique metric - highlight it and let's talk about it.

CUSTOMERS

Startups exist to serve their customers. To solve a problem. This is why it is critical to talk to customers as part of diligence.

Remember when we said customers were a key component of product diligence? Let’s talk about it now.

Investors like talking to current customers to understand:

- Quality: In this context, “quality” implies fit. How well does the customer fit the ideal customer profile? In addition, are these customers SMBs, Mid-market, or Enterprise? If your target customers love the product, but keep going out of business, that’s not great (bigger risk with SMB than Enterprise).

- Satisfaction: Is the product solving their problem? Is it a nice to have or a must have solution? Will they pay more for this?

- Usage: Who uses the product? Is usage increasing or decreasing over time?

- Decision Making Process: How did they evaluate solutions in the market to pick this particular solution?

In addition to current customers, some VCs also like to talk to churned customers to understand the underlying cause of churn. Some churn is unavoidable (company shut down) and some desirable (non-target ICP customer taking up way too many resources). But understanding any product shortcomings that led to churn helps focus our efforts on how to fix them (and if they are fixable).

Successful founders:

- Protect customer time and only offer customer calls to the lead investor (and in rare cases a few key non-lead investors that are writing a big check in the round)

- Offer customer calls towards the end of diligence (mostly after term sheet)

- Keep detailed customer case studies - both positive and negative to support their market segmentation and ICP decisions

LEGAL

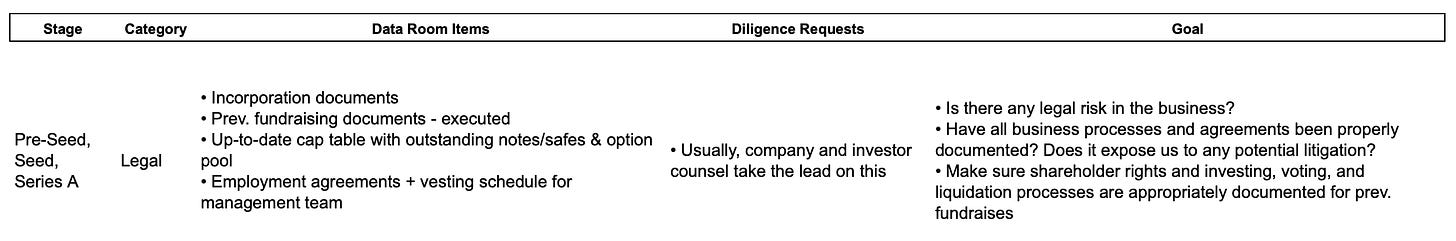

Despite how boring it can seem, legal and governance due diligence is important to evaluate any future legal risk. As companies scale, documentation around control, voting, and ownership become extremely important so it's critical to scrutinize them often and early.

Corporate & Equity Docs: VCs want to see that a company is actually officially registered as a company and that all key decisions and governance rules have been properly initiated and recorded through legal documents. The most important high level items are incorporation docs, cap table and ownership structure, vesting schedules, and voting provisions.

Intellectual Property: Highlight critical IP that underpins your product and who has ownership of that IP. This is also a critical piece of demonstrating defensibility in some industries where patents and defensible IP can create winners.

Financial: Hold up, we just went through a whole Finance section, why are we talking about finance again? Well, in this case I am talking about legal documents that govern any key financial transactions – including prev. fundraises and any outstanding debt.

Legal diligence usually happens in two phases – first, surface level diligence early in the process to quickly identify any major red flags (and deal breakers), and second, post-term sheet as the funding documents are generated by lawyers.

CONCLUSION

Finally, VCs are also doing a lot of research on their own. Market research, industry reports, expert calls, and market data number crunching. Founders should feel empowered to ask investors to share this research as part of their decision making process. The most important thing to remember - VCs exist to serve founders so don’t be afraid to own the fundraising process and be proactive. The best venture funds, make diligence feel like a collaborative journey of self discovery. It should not feel like being at a dentist’s office (unless you love dentist visits…I don’t). The process outlined above generally covers how early stage venture firms think about due diligence, though some firms might have their own quirks not covered above. You are the world’s foremost expert on your business, and diligence is the perfect platform to showcase this expertise.